The Big Mac PPP Index

"Everything Starts Out Looking Like a Toy" #79

Join smart, curious folks to get the Data Ops 📊 newsletter each week (it’s free!)

Today, we’re looking at the world of Fast Food for data patterns and insights. We’ll provide the data snacks to go with it. If you need a background on how we got here, check out What is Data Operations?

This week’s toy: a robotic bartender. This tabletop mixer makes drinks in a “touchless and human-free interaction.” I’m not sure that removing the bartender from a bar is a good idea, but it’s clearly one that offers economic opportunity. Edition #79 is here - it’s Monday, January 31, 2022.

The Big Idea

A short long-form essay about data things

⚙️ What’s making that burger more expensive?

Wondering why that 🍟 is more expensive? If you’ve gone out to eat recently, you’ve seen the signs of higher prices. And I’m not talking about neon signs - if you’re looking for that, check out this awesome list from the library of congress – I’m talking about the signs of inflation in the economy that are making your breakfast, lunch, or dinner at the local restaurant a bit more expensive.

The simple definition of inflation is a decline of the purchasing power of currency over time. When consumers expect that things in the future will cost more on a permanent basis, that means they will be willing to pay more if the demand is still high and there are no suitable alternatives.

For the restaurant owner, rising prices are a double-edged sword. They offer the opportunity to charge more for goods, and the input costs required for the goods (labor, food, rent, and utilities) may also be rising at the same time.

Pricing in a market with lots of demand is a good place to observe the overall economy. What’s a good place to look for this? The world of Fast Food.

Why look at Fast Food?

We know that fast casual chain restaurants are something that people visit in the US regardless of income. If people are going out to eat more often as the COVID19 Pandemic continues, and if they are choosing to do so at fast casual restaurants, we should expect to see more demand. Here’s one indicator of fast food chain visits changing in early 2021.

If restaurants visits are going up, that’s a measure of aggregate demand. People are choosing to go out to eat more often, and they are going out to buy more fast food.

Food Costs have gone up

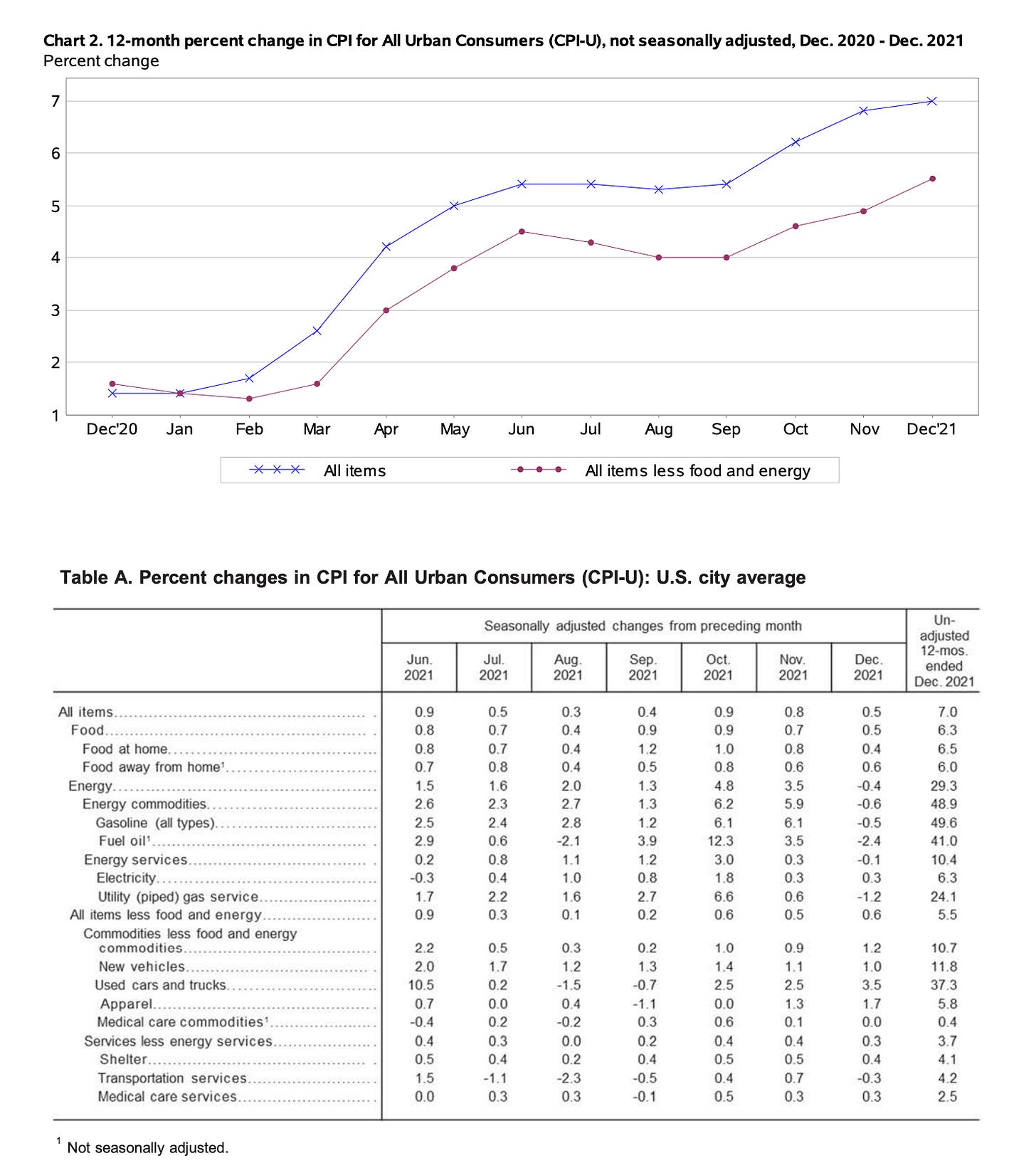

Demand is higher, so what’s happening with supply? We don’t know directly, although there have been a number of intermittent supply problems due to the pandemic. One sign that supply might be constrained is to look at price increases in the consumer price index.

If you’ve ever seen this curve in an econ class, it suggests that the combination of raising demand, especially when the quantity of things is constrained, causes higher prices (a higher clearing price).

Combine more demand with supply constraints and you’d expect … higher prices in fast food. It’s hard to make more burgers when you’re already pretty efficient.

Food costs are a proxy for the rest of the economy

As fast food goes, so goes the economy. Looking at the change of prices over the preceding 12 months, there was a huge jump in prices at the beginning of 2021. Things have leveled off a bit but we are still seeing the “bullwhip” effect of demand and supply shocks interplaying with each other.

What’s the long term impact?

Tl;dr - we don’t know. We do know that a proxy of demand in the US economy is showing increased demand for fast casual food. During the pandemic, people seem to be increasing the behavior of eating out over cooking at home, especially when they can get food delivered or dropped curbside at the drive through window.

If you squint and look at the franchisees of these fast food restaurants as a proxy for the economy, you are seeing two things happen at the same time:

increases in aggregate demand - consumers want the product and are willing to pay for it

increases in the input cost for these restaurants - the low wage workers at these restaurants are seeing their costs go up; the ingredients for the food are becoming more expensive; and their rent is not going down.

If these increases are sustained, then these businesses need to raise their prices to pay for their franchise costs, including a cut of ongoing business.

Note: this is not exactly the same as running any restaurant. It is a highly optimized version of running a restaurant that is more about order taking than demand generation. Compare this with an example of independent restaurant finances, where the end result is pretty modest.

What’s the takeaway? Fast food restaurants are a proxy for widespread demand in the US economy. If you’re seeing a more expensive burger or burrito, it’s probably not going to go back to the former price anytime soon due to the embedded costs fast-food franchisees have built into their business. All of this is due to strong demand where consumers don’t want to cook at home.

A Thread from This Week

A Twitter thread to dive into a topic

If you want to know a bit more about the economics of owning a fast food brand, not just being a franchisee or a customer, here’s an unusual insight. Fast food brands are sitting on enormous real estate resources, particularly McDonald’s.

Links for Reading and Sharing

These are links that caught my 👀

1/ How much does a Big Mac cost? - The Economist maintains a Big Mac index as a measure of PPP (purchasing parity power) and relative pricing in different countries. Because McDonald’s wants to have a consistent product all around the world, this is an interesting way to show the purchasing power for consumers in different countries to buy the same goods.

2/ What happens to a burger if you don’t eat it? - Most people probably don’t leave a hamburger under glass to see what happens. Here’s how a McDonald’s burger became a historical artifact in Iceland.

3/ What do meal prices look like? - “a fast-food delivery meal is now about the same price as a lower-end full-service restaurant meal.” Fast food prices are increasing. The interesting tidbit here? Delivery is becoming an expected channel along with in-store and at-home dining due to the ubiquity of UberEats, Doordash, and the enormous amount of marketing dollars devoted to delivery.

On the Reading/Watching List

Some things to watch or read, in no particular order

Watching: To go along with the fast food focus this week, I’m watching the 2016 Michael Keaton movie on Ray Kroc, a biopic of the McDonald’s founder.

Reading: For another bookend of the fast food topic, I’m looking forward to reading Adam Chandler’s book “Drive-Thru Dreams: A Journey Through the Heart of America's Fast-Food Kingdom.”

What to do next

Hit reply if you’ve got links to share, data stories, or want to say hello.

I’m grateful you read this far. Thank you. If you found this useful, consider sharing with a friend.

Want more essays? Read on Data Operations or other writings at gregmeyer.com.

The next big thing always starts out being dismissed as a “toy.” - Chris Dixon

if you're wondering what prices look like for Pizza, this helpful infographic gives you some insight: https://www.expensivity.com/pizza-index/