Gamestop: a new meme stock

"Everything Starts Out Looking Like a Toy" (No.31)

This week’s toy is a little bit different. A software engineer (@nick_sawney) created a website that mashed up a picture of Bernie Sanders and any image you can find on Google Maps street view. The site is archived now as Nick couldn’t afford the millions of viral views he was seeing, but this should give you an idea of the result.

A small idea can have big impact, which is the theme of this week’s news. Edition No. 31 of this newsletter is here - it’s January 30, 2020.

The Big Idea

Small bets - especially when they come from lots of people - can move markets. I’m not a market analyst or a professional trader, and I am fascinated by what happened this week on Wall Street.

A quick disclaimer - this is not investment advice, and you should make your own financial decisions regarding any moves you make in the stock market.

Small Decisions, Big Momentum

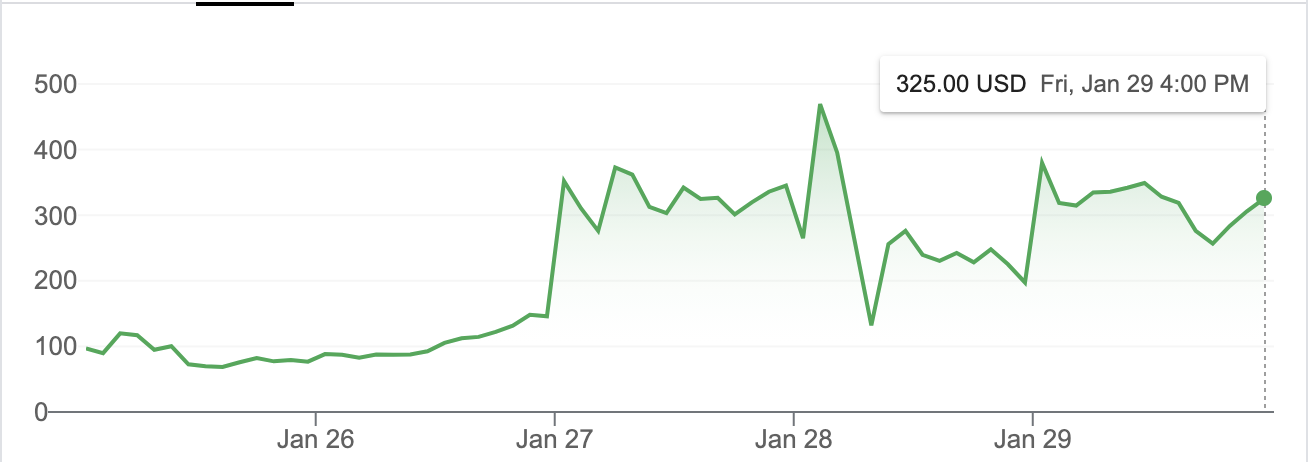

In case you haven’t heard, many individual traders tried to beat a hedge fund at their own game this week: thwarting a short attempt on Gamestop stock. The game is still ongoing and it’s unclear how it will end. John Maynard Keynes once wrote: “the markets can remain irrational longer than you can remain solvent.” In this case some hedge funds will go out of business, some individual traders will become fabulously wealthy, and some investors will probably lose lots of hard-earned cash.

What’s interesting to me about this event is that it upends or disrupts the narrative that professional stock traders and hedge funds are often (or right more often than random). If coordinated effort that started as a joke among Redditors can roil financial markets, what do financial regulators need to do to improve these systems?

Remove Loopholes that seem unfair

One way this whole thing started was human behavior that allowed the possibility of more short coverage on a stock than the entire float of the stock. The combination of traders competing to borrow and sell shares and the Reddit group is a crazy combination that we are likely to see again. But what if it was essentially impossible to short a stock beyond 100% of float? You’d definitely have a short squeeze like the one we’ve seen with GME, but it would hypothetically resolve faster and would have a less volatile magnitude.

Today it takes 2 days for stocks to clear a trade. This combination of wild stock activity and the need to settle trades caused Robinhood to take extraordinary actions. If those trades could have cleared instantly, would the squeeze have resolved?

Instant clearing of trades would make this better

We need faster resolution of trading activity to prevent situations where brokers get squeezed for capital because their customers are trading on margin and they need to wait for two days for the trades to clear. If trades could be resolved instantly the brokers would have less existential worry about surviving a capital call while still offering services to customers. This raises a few other questions that make me wonder how the process works today.

The basis of a delay for clearing trades is that the broker wants to make sure that you are good for the money and that all sides of the transaction have completed before you make another transaction with that stock. Otherwise, the transaction doesn’t have strict consistency - meaning you can’t unwind it and reverse what’s going on. If a bad actor made trades and then continued to make trades when they didn’t have funds to make those trades, which ones are invalidated? You’d have to fix all of them.

A Better System

If you always knew - instantly - where your money was and were able to transfer money instantly to the other party, then perhaps the combination of a temporary escrow (long enough for the transaction to complete) and an instant update would make the process more like minutes or seconds instead of days.

Today this involves a series of financial clearinghouses and their interconnected transactions. I am sure there are some technological levers - particularly to decentralize this a bit - that could help, but I’m guessing the real challenge to this is the scale of the transactions that need to happen. Billions of shares and millions of transactions happen per day, and multiplying that times the number of parties in each share suggest a lot of data has to move around daily.

What’s the takeaway? The current systems for financial clearinghouses need updating to get acclimated to the digital speed of trading today. Whether that ends up being a centralized or a decentralized solution remains to be seen.

Links for Reading and Sharing

These are links that caught my eye.

1/ Feeling blue? - the first new blue pigment in nearly 200 years is now commercially available. YInMn Blue is made from rare earth elements and costs about $165/tube. But it mixes up a sweet purple.

2/ 🏀 ball don’t lie - the NBA is considering ownership changes allowing private equity firms to invest in teams, and to own stakes in up to 5 teams. This is an interesting fusion of sports and commerce. The NBA is global and big for business - one wonders where the partnership will go next? One guess: preferred vendors for NBA teams based on portfolio companies in PE.

3/ 2021 predictions - some of the best tech predictions come from Dave Kellogg. He is long on data intelligence - or the coalescing of a lot of data organization into catalogs. Without agreement in an organization of our shared definitions and metrics, how can we hope to analyze those outcomes with automated tools that have different biases?

On the Reading/Watching List

I’m waiting for the yearly Brand Bowl - the commercials that go along with the Super Bowl - because they often provide a window into the creative zeitgeist of advertising. Will this be a year of talking animals, serious calls for unity, painfully unfunny cringe ads, or will there be some surprises? Budweiser has already announced they will spend some of their ad budget on COVID19 relief instead.

On getting better - we all sometimes struggle with our inner voice. Ethan Kross has written a new book called Chatter on listening, understanding, and channeling that inner voice.

What to do next

Hit reply if you’ve got links to share, data stories, or want to say hello.

I’m grateful you read this far. Thank you. If you found this useful, consider sharing with a friend.

Want more essays? Read on Data Operations or other writings at gregmeyer.com.

The next big thing always starts out being dismissed as a “toy.” - Chris Dixon